Retiring as a self-employed individual requires careful planning and strategic financial management. Unlike traditional employees who may have employer-sponsored retirement plans, self-employed individuals must take the initiative to create and fund their own retirement savings. Below is a comprehensive guide that outlines the essential steps to achieve a comfortable retirement while being self-employed.

Understanding Your Retirement Needs

Before diving into strategies for retirement, it's crucial to assess your ''retirement needs''. This involves estimating how much money you will require to maintain your lifestyle after you retire. Consider factors such as:

- Current and future living expenses

- Healthcare costs

- Inflation

- Desired lifestyle changes

Having a clear understanding of these factors will help you set a realistic retirement savings goal.

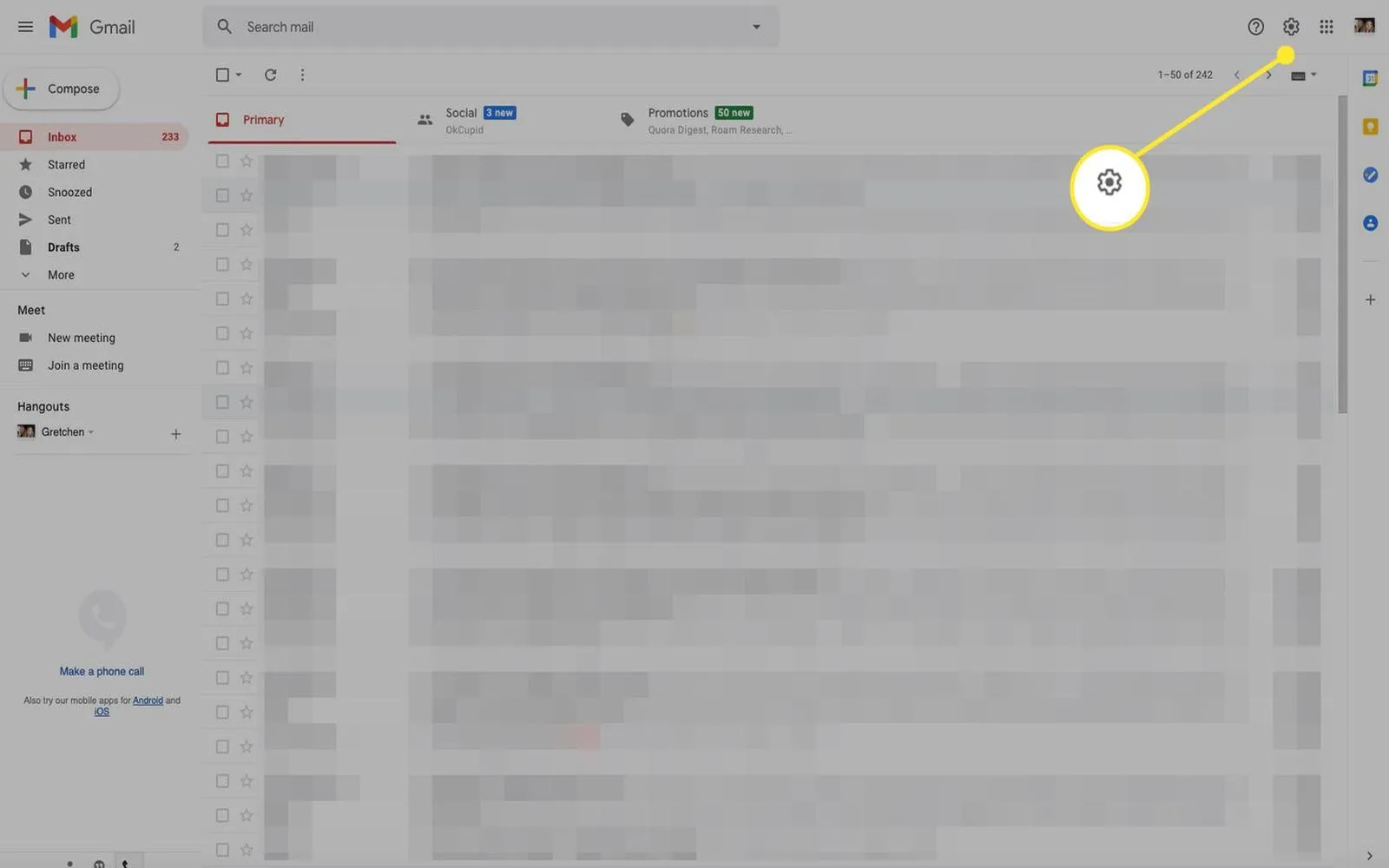

Choosing the Right Retirement Accounts

As a self-employed individual, you have several retirement account options to choose from. Each has its own contribution limits, tax advantages, and withdrawal rules. Here are the most popular options:

| Retirement Account | Contribution Limit (2023) | Tax Advantages |

|---|---|---|

| Solo 401(k) | $66,000 | Tax-deferred growth; potential for Roth contributions |

| SEP IRA | $66,000 | Tax-deferred growth; easy to set up |

| SIMPLE IRA | $15,500 | Tax-deferred growth; lower administrative costs |

Choosing the right account depends on your income, business structure, and retirement goals. Consult a financial advisor to find the best fit for your situation.

Creating a Retirement Savings Plan

Once you've chosen your retirement account, it's time to create a ''savings plan''. A well-structured plan should include:

- A percentage of your income allocated to retirement savings

- A timeline for reaching your retirement savings goals

- A strategy for increasing contributions as your income grows

Consistency is key. Automating your contributions can help ensure you stay on track.

Investing Wisely for Retirement

Investing is a critical component of growing your retirement savings. The right investment strategy can dramatically impact your nest egg. Consider the following tips:

- Diversify your investment portfolio to spread risk.

- Consider a mix of stocks, bonds, and mutual funds based on your risk tolerance.

- Stay informed about market trends and adjust your portfolio as needed.

Investing wisely is essential to ensure your money works for you as you prepare for retirement.

Managing Your Taxes

Self-employed individuals have unique tax considerations. Managing your taxes effectively can help you maximize your retirement savings. Here are some strategies:

- Deduct retirement contributions from your taxable income.

- Keep track of business expenses that may qualify for deductions.

- Consider working with a tax professional to optimize your tax strategy.

Understanding the tax implications of your retirement savings can significantly enhance your financial position.

Planning for Healthcare Costs

Healthcare is one of the most significant expenses retirees face. As a self-employed individual, you need to plan for potential medical costs in retirement. Consider the following:

- Research healthcare insurance options available to self-employed individuals.

- Consider setting up a Health Savings Account (HSA) for additional savings.

- Factor healthcare costs into your overall retirement budget.

By planning for healthcare, you can reduce the financial burden and enjoy your retirement with peace of mind.

Knowing When to Retire

Deciding when to retire is a personal choice influenced by various factors, including financial readiness, health, and personal goals. Consider these aspects when making your decision:

- Your savings and investments

- Your overall health and life expectancy

- Your desire to continue working part-time or pursuing hobbies

Take the time to evaluate these factors carefully to determine the best retirement timeline for you.

Staying Flexible and Adaptable

Finally, it's essential to remain flexible and adaptable as you approach retirement. Economic conditions, personal circumstances, and health may change, affecting your retirement plans. Here are some tips:

- Regularly review and adjust your retirement plan as necessary.

- Stay informed about changes in tax laws and retirement account regulations.

- Be prepared to pivot your investment strategy based on market conditions.

By staying proactive, you can better manage changes and ensure a smooth transition into retirement.

In conclusion, retiring when you are self-employed requires strategic planning, a solid understanding of your financial needs, and effective management of your retirement savings. With the right approach, you can achieve a financially secure and fulfilling retirement.