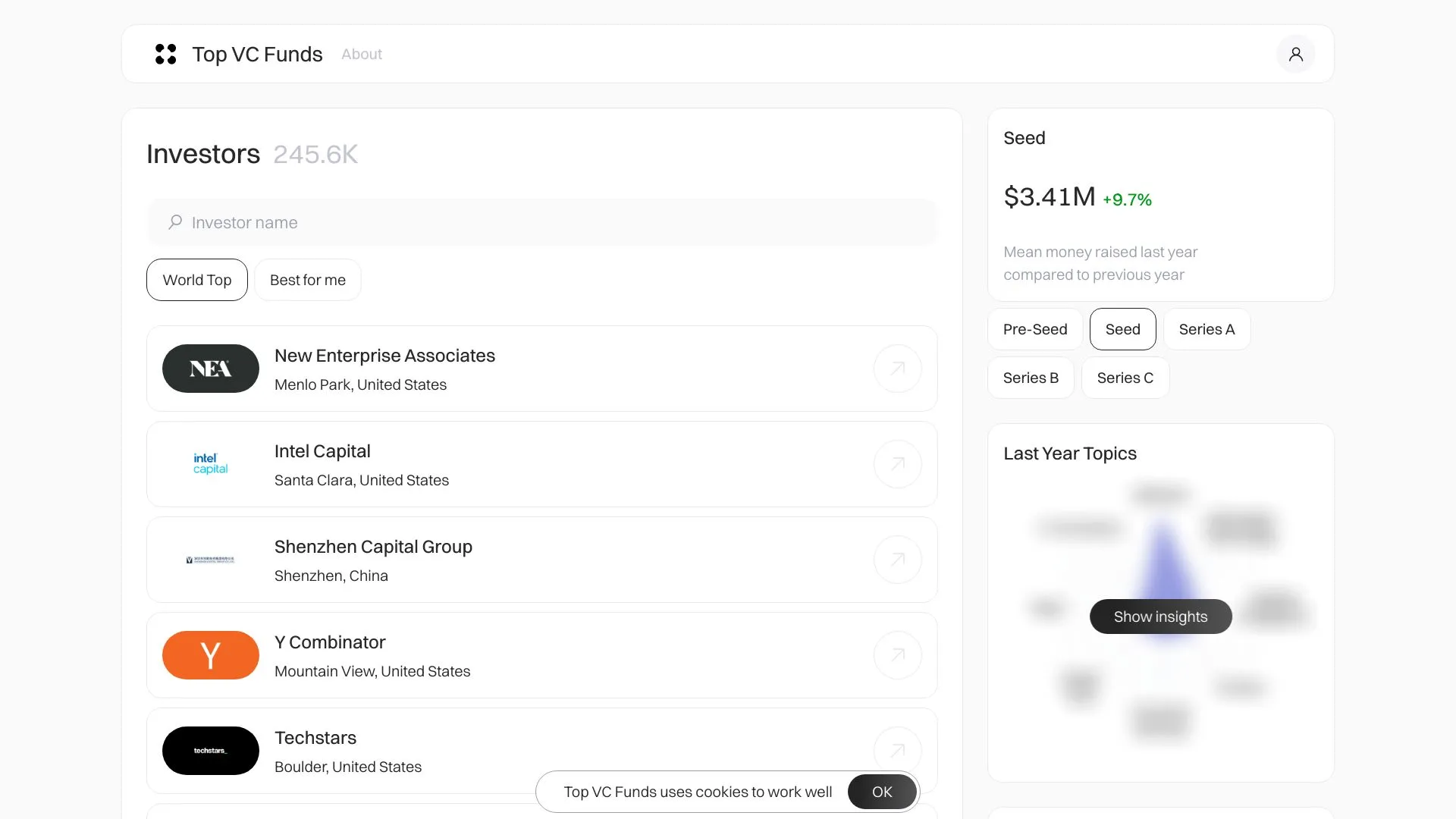

Top VC Funds  Open site

Open site

4.6

Introduction:

Top VC Funds is a comprehensive resource dedicated to showcasing the leading venture capital funds in the industry. It serves as a platform for entrepreneurs, investors, and anyone interested in the venture capital landscape to explore a curated list of top-performing funds. With a focus on transparency and accessibility, the site aims to bridge the gap between budding startups and potential investors, facilitating valuable connections that drive innovation and growth.The platform highlights key information about each fund, including their investment strategies, portfolio companies, and performance metrics. By providing insights into the diverse range of venture capital firms, Top VC Funds empowers startups to make informed decisions when seeking funding. Whether you are an entrepreneur looking for investment or an investor seeking new opportunities, this resource offers valuable guidance in navigating the dynamic world of venture capital.

What is Top VC Funds?

Top VC funds typically boast a strong track record, showcasing successful past investments that demonstrate their ability to identify and nurture high-potential startups. This history not only builds credibility but also attracts entrepreneurs seeking funding.

These funds often have a diverse and experienced team, combining expertise in finance, technology, and industry-specific knowledge. This diverse skill set enables them to provide valuable insights and guidance to portfolio companies.

Robust networks are another essential feature, allowing VC funds to connect startups with potential partners, customers, and additional investors. Such connections can significantly enhance a startup's growth trajectory.

A clear investment thesis helps top VC funds define their focus areas, guiding their decision-making processes. This clarity enables them to concentrate on sectors where they can leverage their strengths and insights.

Lastly, strong operational support is a hallmark of leading VC funds. They often assist portfolio companies with strategic planning, talent acquisition, and market entry strategies, fostering an environment where startups can thrive.

Key Features:

- Top VC funds typically boast a strong track record, showcasing successful past investments that demonstrate their ability to identify and nurture high-potential startups. This history not only builds credibility but also attracts entrepreneurs seeking funding.

- These funds often have a diverse and experienced team, combining expertise in finance, technology, and industry-specific knowledge. This diverse skill set enables them to provide valuable insights and guidance to portfolio companies.

- Robust networks are another essential feature, allowing VC funds to connect startups with potential partners, customers, and additional investors. Such connections can significantly enhance a startup's growth trajectory.

- A clear investment thesis helps top VC funds define their focus areas, guiding their decision-making processes. This clarity enables them to concentrate on sectors where they can leverage their strengths and insights.

- Lastly, strong operational support is a hallmark of leading VC funds. They often assist portfolio companies with strategic planning, talent acquisition, and market entry strategies, fostering an environment where startups can thrive.

Pros

Top VC funds provide access to substantial capital, enabling startups to scale rapidly. This financial backing allows entrepreneurs to focus on product development and market penetration without the constant worry of funding shortfalls.

Additionally, these funds often come with valuable industry connections. By leveraging their networks, top VC firms can introduce startups to potential customers, strategic partners, and talent, significantly enhancing their chances for success.

Moreover, leading VC funds offer strategic guidance and mentorship. Their experienced teams can provide insights on business strategy, operational efficiency, and market trends, helping startups navigate challenges more effectively.

Lastly, top VC funds often foster a strong reputation in the market. This credibility can attract further investment, top-tier talent, and increased media attention, positioning startups for greater visibility and potential growth.

Cons

Top VC funds often have limited availability for new investors, making it challenging for smaller or newer investors to gain access. This exclusivity can perpetuate a cycle where only the wealthiest individuals or institutions can participate in lucrative investment opportunities, thereby widening the gap between affluent investors and those without established connections in the industry.

Additionally, the pressure for high returns in top VC funds can lead to a focus on short-term gains rather than sustainable growth. This might encourage riskier investment decisions, pushing startups to prioritize rapid scaling over developing solid business fundamentals, which can ultimately harm long-term viability.

Another downside is the potential for high fees associated with top VC funds. Management fees and carried interest can significantly erode overall returns, particularly for smaller investments. This financial burden may deter some investors from committing their capital, especially in scenarios where the expected returns do not justify the costs.

Finally, the competitive nature of top VC funds can create a herd mentality, where many investors rush into similar opportunities. This can lead to inflated valuations and a lack of diversification in investment portfolios. As a result, the potential for losses increases if the market turns, leaving investors vulnerable to downturns.

Top VC Funds's Use Cases

#1

venture capital, competitor analysis, startup, funding

Top VC Funds Reviews

Top VC Funds are pivotal in driving innovation and entrepreneurship. They provide essential capital and mentorship to startups, fostering growth in various sectors. With a keen eye for potential, these funds often identify disruptive technologies and promising founders early on. Their strategic investments not only yield significant returns but also shape the future of industries. Overall, Top VC Funds play a crucial role in the startup ecosystem, supporting the next generation of groundbreaking ideas and solutions.

Alternative of Top VC Funds

334.8M

4.9

Adobe is a global leader in digital media and digital marketing solutions, empowering individuals and organizations to create, communicate, and deliver exceptional content. Founded in December 1982, Adobe is renowned for its innovative software products that revolutionize the way people engage with digital experiences. From graphic design to video editing, Adobe's suite of tools, including Photoshop, Illustrator, and Premiere Pro, are integral to the creative workflows of professionals across various industries.In addition to its creative solutions, Adobe offers a robust range of digital marketing tools through Adobe Experience Cloud. These tools help businesses optimize customer engagement and drive growth by providing insights and analytics. With a commitment to innovation and creativity, Adobe continues to shape the future of digital experiences, making it an essential partner for creators and marketers alike.

AI Ad Generator

69.7M

4.5

Shutterstock is a leading global provider of high-quality visual content, offering a vast library of images, videos, and music to enhance creative projects. Founded in 2003, the platform connects businesses, marketers, and creatives with a diverse range of media assets, making it easier to find the perfect visuals for any need. With millions of stock photos, illustrations, vectors, and audio tracks, Shutterstock caters to a wide array of industries and creative endeavors.Committed to innovation, Shutterstock continuously evolves its offerings through advanced search technologies, user-friendly interfaces, and flexible licensing options. The platform also prioritizes the empowerment of contributors by providing a fair marketplace for artists to showcase their work. Whether for advertising, social media, or personal projects, Shutterstock remains a go-to resource for those seeking inspiration and quality content in the digital age.

AI Ad Generator

10.0M

4.5

InVideo is an innovative online video creation platform designed to empower users to produce professional-quality videos with ease. Catering to marketers, businesses, and content creators, it offers a user-friendly interface that simplifies the video editing process. With a vast library of templates, stock footage, music, and visual assets, InVideo enables users to craft engaging videos for various purposes, including social media, advertisements, and presentations.The platform boasts advanced features such as text overlay, voiceovers, and customizable animations, making it accessible for both novices and experienced videographers. InVideo also supports collaboration, allowing teams to work together seamlessly on projects. By combining creativity with efficiency, InVideo stands out as a comprehensive solution for anyone looking to enhance their video marketing efforts and storytelling capabilities.

AI Ad Generator

5.1M

4.5

Pika is a dynamic platform that empowers artists and creators by enabling them to showcase their work and connect with a global audience. Focused on the intersection of art and technology, Pika offers innovative tools that help users express their creativity and engage with their followers. The platform aims to create a vibrant community where artistic talent can thrive and be recognized.With features designed to enhance user experience, Pika facilitates the creation, sharing, and discovery of art in various forms. It promotes collaboration and interaction among artists, fostering an environment that celebrates creativity and originality. By leveraging the power of digital technology, Pika stands out as a go-to destination for those looking to explore and appreciate contemporary art.

AI Ad Generator

4.5M

4.5

hCaptcha is a privacy-focused alternative to traditional CAPTCHA services, designed to enhance website security while protecting user data. It allows website owners to verify that their visitors are human without compromising their privacy. By utilizing a robust set of challenges, hCaptcha helps prevent automated abuse, ensuring a safer online experience for both users and site operators.In addition to its security features, hCaptcha offers a unique monetization opportunity for website owners. Each time a user completes a challenge, site owners can earn revenue, turning a necessary security measure into a potential income stream. This dual benefit of security and monetization makes hCaptcha an appealing choice for businesses looking to maintain user trust while safeguarding their platforms.

AI Ad Generator

3.7M

4.8

Opus Clip AI is an innovative platform designed to streamline the video editing process by harnessing the power of artificial intelligence. It enables users to create engaging short clips from longer video content effortlessly, making it easier to share highlights on social media or other platforms. The technology analyzes video footage to identify key moments, allowing for quick and efficient editing that saves time and enhances creativity.With Opus Clip AI, both content creators and marketers can maximize the impact of their videos by focusing on the most compelling segments. The platform caters to a diverse range of users, from professional filmmakers to casual creators, providing tools that facilitate seamless editing and content repurposing. By simplifying the video editing workflow, Opus Clip AI empowers users to expand their reach and engage audiences more effectively.

AI Ad Generator