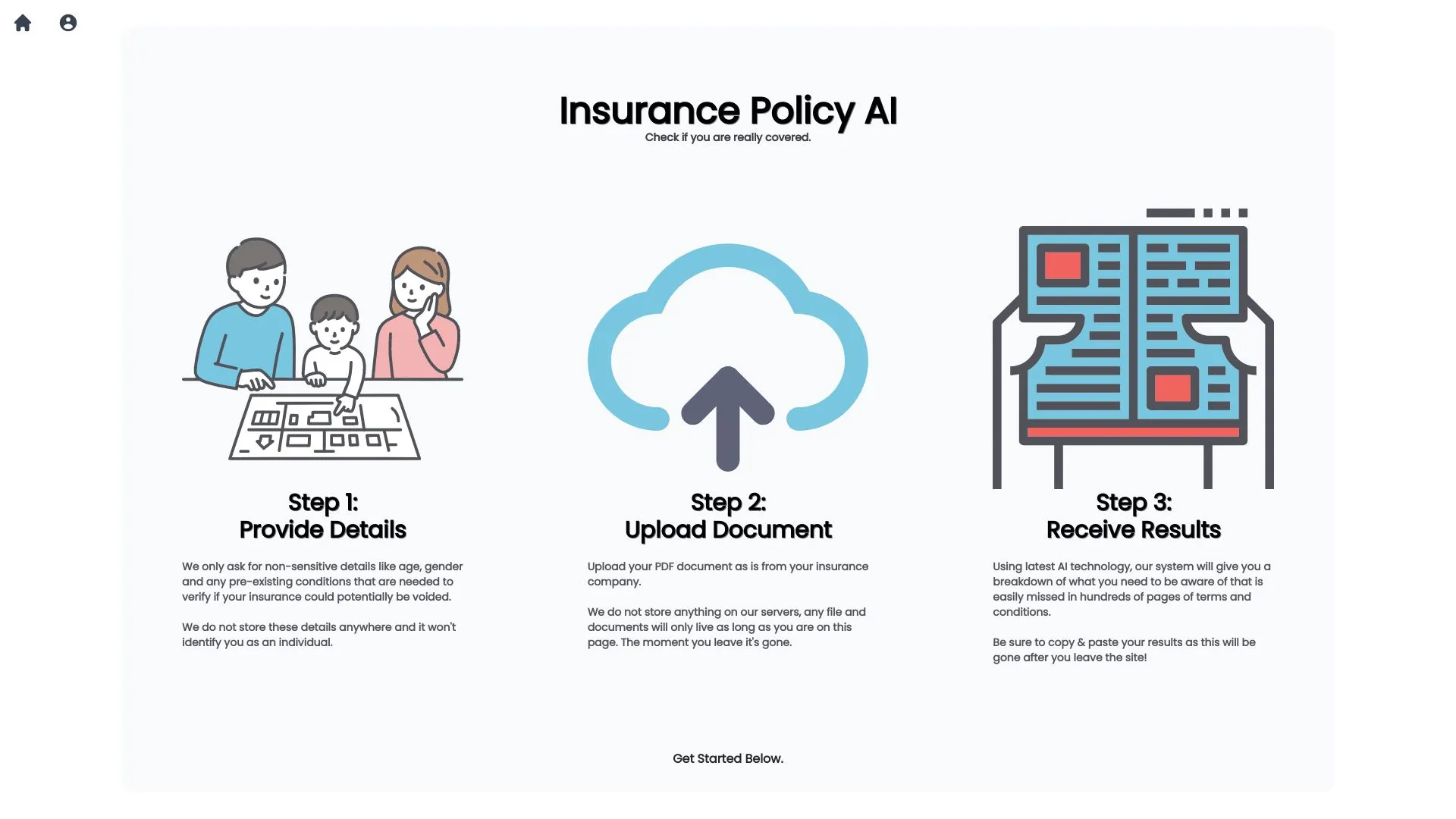

Insurance Policy Ai  Open site

Open site

4.7

Introduction:

Insurance Policy AI is a cutting-edge platform designed to streamline and enhance the insurance policy management process through artificial intelligence. By leveraging advanced technology, it provides users with tools to efficiently analyze, compare, and manage their insurance policies. This innovative approach aims to simplify the often complex and overwhelming world of insurance, making it more accessible and user-friendly.The platform empowers individuals and businesses to make informed decisions by offering personalized insights and recommendations tailored to their unique needs. With a focus on transparency and efficiency, Insurance Policy AI seeks to transform the way users interact with their insurance policies, ensuring they understand their coverage fully and can optimize their choices for better financial protection.

What is Insurance Policy Ai?

Insurance Policy AI offers personalized policy recommendations by analyzing individual needs and preferences, ensuring that customers receive coverage tailored specifically to their situation. This feature enhances customer satisfaction and increases the likelihood of finding an ideal policy.

Another feature is automated claims processing, where AI streamlines the claims experience by quickly assessing claims, verifying information, and facilitating faster payouts. This efficiency reduces the time and effort required from both customers and insurers.

Additionally, Insurance Policy AI provides risk assessment tools that leverage data analytics to identify potential risks associated with policyholders. This proactive approach helps insurers adjust premiums and coverage options based on real-time insights, promoting better risk management.

Lastly, continuous learning capabilities enable the AI to adapt and improve over time. By analyzing feedback and outcomes, it refines its recommendations and processes, ensuring that the insurance experience evolves with changing customer needs and market conditions.

Key Features:

- Insurance Policy AI offers personalized policy recommendations by analyzing individual needs and preferences, ensuring that customers receive coverage tailored specifically to their situation. This feature enhances customer satisfaction and increases the likelihood of finding an ideal policy.

- Another feature is automated claims processing, where AI streamlines the claims experience by quickly assessing claims, verifying information, and facilitating faster payouts. This efficiency reduces the time and effort required from both customers and insurers.

- Additionally, Insurance Policy AI provides risk assessment tools that leverage data analytics to identify potential risks associated with policyholders. This proactive approach helps insurers adjust premiums and coverage options based on real-time insights, promoting better risk management.

- Lastly, continuous learning capabilities enable the AI to adapt and improve over time. By analyzing feedback and outcomes, it refines its recommendations and processes, ensuring that the insurance experience evolves with changing customer needs and market conditions.

Pros

Insurance Policy AI enhances efficiency by automating routine tasks such as claims processing and policy management. This reduces the workload on human agents, allowing them to focus on complex cases and customer interactions, ultimately improving service delivery.

Another advantage is the ability to analyze vast amounts of data quickly. AI can identify trends and assess risks more accurately, enabling insurers to tailor policies and pricing based on individual customer profiles, leading to better customer satisfaction.

AI also improves fraud detection by using sophisticated algorithms to identify suspicious patterns and behaviors. This proactive approach helps insurers mitigate losses and maintain lower premiums for honest policyholders, fostering a more secure insurance environment.

Cons

One significant con of using AI in insurance policies is the potential for bias in decision-making. If the data used to train AI algorithms is flawed or unrepresentative, it may lead to unfair treatment of certain demographic groups. This can result in discrimination, which not only harms individuals but also damages the insurer's reputation and trustworthiness.

Another drawback is the lack of human touch in customer service. While AI can efficiently process claims and provide information, it often fails to address complex emotional needs or unique situations that require empathy and understanding. This can lead to customer dissatisfaction and a perception that the insurer is impersonal or unapproachable.

Data security is also a major concern with AI in insurance. The use of vast amounts of personal data increases the risk of breaches and unauthorized access. If sensitive information is compromised, it can lead to significant financial losses and legal repercussions for the insurer, as well as a loss of trust from policyholders.

Finally, the reliance on AI can result in job displacement within the insurance industry. As automation takes over tasks traditionally performed by humans, there may be fewer job opportunities available. This shift can lead to workforce challenges and concern among employees about job security and the future of their roles in an increasingly automated environment.

Insurance Policy Ai's Use Cases

#1

Families wanting to ensure their insurance policies are comprehensive and reliable#2

Individuals seeking to understand and improve their policy coverage#3

Insurance agents and brokers wanting to assist their clients better

Insurance Policy Ai Reviews

Insurance Policy AI offers a seamless experience for managing and understanding insurance policies. Its user-friendly interface simplifies complex terms, making it easier for users to find the coverage they need. The AI-driven insights help identify potential gaps in coverage and suggest appropriate adjustments. Overall, it’s a valuable tool for both individuals and businesses looking to optimize their insurance options efficiently.

Alternative of Insurance Policy Ai

4.9M

4.5

Casetext is an innovative legal research platform designed to enhance the efficiency and effectiveness of legal professionals. By leveraging advanced artificial intelligence, Casetext provides users with powerful tools to search through vast databases of legal documents, cases, and statutes. Its user-friendly interface allows attorneys to quickly find relevant information, streamlining the research process and enabling them to focus on building strong legal arguments.In addition to its comprehensive legal database, Casetext offers features like CoCounsel, an AI-powered assistant that helps users draft documents, conduct research, and analyze case law. By integrating cutting-edge technology with traditional legal practices, Casetext aims to empower lawyers and improve access to legal resources, ultimately transforming the way legal research is conducted and enhancing the overall practice of law.

AI Contract Management

3.7M

4.7

HelloSign is a leading electronic signature platform designed to simplify the signing process for businesses and individuals. With its user-friendly interface, HelloSign allows users to sign documents digitally, making it easier to handle contracts, agreements, and other important paperwork without the hassle of printing, scanning, or mailing. The platform integrates seamlessly with popular applications, enhancing workflow efficiency and ensuring that users can manage their documents from a centralized location.In addition to electronic signatures, HelloSign offers features such as template creation, in-person signing, and robust security measures to protect sensitive information. The platform is suitable for a wide range of industries, catering to the needs of small businesses as well as larger enterprises. With a focus on user experience and compliance with legal standards, HelloSign is dedicated to helping users streamline their document workflows and improve productivity.

AI Contract Management

385.0K

4.9

DemandsAI is a cutting-edge solution designed to streamline and enhance the process of generating legal demands. Aimed at legal professionals and law firms, it leverages advanced artificial intelligence technology to automate the creation of demand letters, ensuring accuracy and efficiency. By simplifying this critical aspect of legal practice, DemandsAI allows attorneys to focus more on strategic decision-making and client relations rather than getting bogged down in administrative tasks.The platform offers customizable templates and features that cater to various legal scenarios, making it versatile for different types of cases. With its user-friendly interface, DemandsAI not only saves time but also reduces the potential for errors, ultimately improving overall productivity within legal teams. By integrating technology into the legal workflow, DemandsAI represents a significant advancement in how law firms operate in the digital age.

AI Contract Management

143.7K

4.7

LinkSquares is a cutting-edge contract lifecycle management platform designed to streamline the way businesses manage their agreements. By leveraging advanced artificial intelligence and machine learning technology, LinkSquares allows organizations to gain valuable insights from their contracts, improving efficiency and reducing risks associated with contract management. The platform enhances visibility into contractual obligations, enabling teams to make data-driven decisions and optimize their legal processes.With a focus on user-friendly design and robust features, LinkSquares caters to various industries, providing tools that facilitate collaboration between legal, finance, and operational teams. The solution aims to transform the traditional approach to contract management by automating processes and ensuring compliance, ultimately empowering businesses to unlock the full potential of their contractual assets.

AI Contract Management

117.9K

4.8

Spellbook is an innovative legal technology platform designed to streamline the contract drafting process for legal professionals. It leverages advanced artificial intelligence to assist lawyers in creating, analyzing, and managing contracts efficiently, ensuring accuracy and compliance. By integrating collaborative tools, Spellbook enhances teamwork among legal teams, allowing for smoother communication and quicker turnaround times on important documents.The platform also emphasizes user-friendly features that cater to both seasoned attorneys and those new to contract law. With its robust templates and intuitive interface, Spellbook not only simplifies the drafting process but also reduces the risk of errors. By harnessing the power of AI, it empowers legal practitioners to focus on higher-value tasks, ultimately transforming the way contracts are handled in the legal industry.

AI Contract Management

56.3K

4.6

RobinAI is an innovative platform designed to simplify and enhance the software development process by leveraging advanced artificial intelligence. It provides developers with tools that automate various coding tasks, improving efficiency and reducing the time spent on repetitive work. By integrating AI capabilities, RobinAI aims to empower teams to focus more on creative problem-solving and delivering high-quality products.The platform is particularly beneficial for organizations looking to streamline their workflows and enhance collaboration among team members. With features that support code generation, documentation, and error detection, RobinAI acts as a comprehensive assistant for developers, enabling them to achieve their goals faster and with greater accuracy. As the demand for rapid software development grows, RobinAI positions itself as a valuable resource in the tech industry.

AI Contract Management