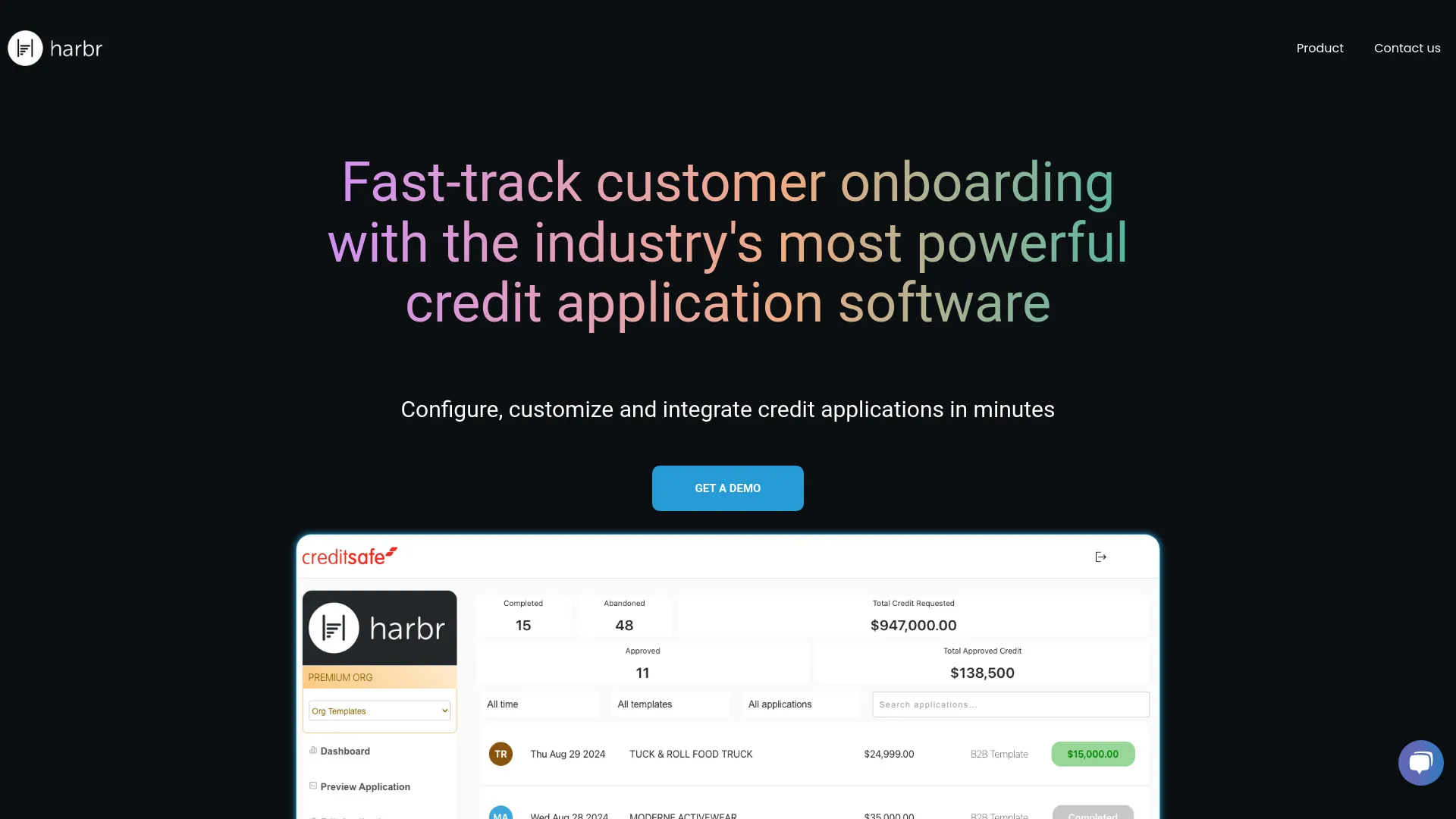

Credit Onboarding Automation  Open site

Open site

4.9

Introduction:

Credit onboarding automation refers to the use of technology to streamline and enhance the process of integrating new clients into a credit system. This process typically involves gathering necessary information, assessing creditworthiness, and facilitating communication between stakeholders. By automating these steps, organizations can reduce manual errors, speed up decision-making, and improve overall efficiency in managing credit relationships.This innovation not only enhances the customer experience by providing faster approvals and clearer communication but also allows financial institutions to allocate resources more effectively. With automated systems, organizations can ensure compliance with regulatory requirements while maintaining high standards of service. Ultimately, credit onboarding automation is a critical advancement for businesses looking to optimize their credit processes and improve customer satisfaction.

Monthly Visitors:

8.1K

What is Credit Onboarding Automation?

Credit Onboarding Automation streamlines the application process by minimizing manual data entry. This feature allows applicants to input their information through user-friendly interfaces, automatically populating necessary fields, which reduces errors and saves time for both applicants and lenders.

Another key feature is real-time credit assessment. By integrating with credit bureaus, the system instantly retrieves credit scores and relevant financial information. This enables quick decision-making, allowing lenders to provide immediate feedback to applicants and enhancing the overall experience.

Additionally, automated document verification enhances security and compliance. The system utilizes advanced algorithms to analyze and validate submitted documents, ensuring they meet regulatory standards. This feature protects against fraud and ensures that only legitimate applications proceed through the onboarding process.

Lastly, customizable workflows offer flexibility to financial institutions. Organizations can tailor the automation process to align with their specific policies and procedures, ensuring that the onboarding experience reflects their unique brand and operational requirements, leading to improved customer satisfaction.

Key Features:

- Credit Onboarding Automation streamlines the application process by minimizing manual data entry. This feature allows applicants to input their information through user-friendly interfaces, automatically populating necessary fields, which reduces errors and saves time for both applicants and lenders.

- Another key feature is real-time credit assessment. By integrating with credit bureaus, the system instantly retrieves credit scores and relevant financial information. This enables quick decision-making, allowing lenders to provide immediate feedback to applicants and enhancing the overall experience.

- Additionally, automated document verification enhances security and compliance. The system utilizes advanced algorithms to analyze and validate submitted documents, ensuring they meet regulatory standards. This feature protects against fraud and ensures that only legitimate applications proceed through the onboarding process.

- Lastly, customizable workflows offer flexibility to financial institutions. Organizations can tailor the automation process to align with their specific policies and procedures, ensuring that the onboarding experience reflects their unique brand and operational requirements, leading to improved customer satisfaction.

Pros

Credit onboarding automation significantly speeds up the application process, allowing lenders to quickly assess and approve loans. This efficiency reduces the time customers spend waiting for decisions, enhancing their overall experience and satisfaction.

Automation minimizes human errors in data entry and analysis, leading to more accurate assessments of creditworthiness. By relying on technology, organizations can reduce the risk of costly mistakes that may arise from manual processing.

Implementing automated systems can lower operational costs by reducing the need for extensive staff involvement in the onboarding process. This allows organizations to allocate resources more effectively and focus on strategic initiatives.

Lastly, credit onboarding automation enables better data analysis and reporting. Organizations can leverage comprehensive insights from automated systems to refine their credit policies and improve risk management strategies.

Cons

Credit onboarding automation can lead to a lack of personalized service. Automated systems often rely on algorithms that may not fully understand individual customer circumstances. This can result in a standardized approach that overlooks unique financial situations or needs, potentially leaving customers feeling undervalued and frustrated.

Another drawback is the risk of data security breaches. Automated systems handle sensitive information, and if not properly secured, they can become targets for cyberattacks. A breach could expose personal financial data, putting customers at risk and damaging the institution's reputation.

Additionally, reliance on automation can lead to technical issues or system failures. If the technology malfunctions or experiences downtime, the onboarding process can be delayed, causing inconvenience for both customers and staff. This can create frustration and lead to lost business opportunities.

Lastly, automation may result in regulatory compliance challenges. Financial institutions must adhere to various regulations, and automated systems may not always keep up with changing legal requirements. This can expose organizations to potential fines or legal issues if compliance is not maintained.

Credit Onboarding Automation's Use Cases

#1

Automate credit application process for faster approvals#2

Optimize onboarding of new customers efficiently

Credit Onboarding Automation Reviews

Credit Onboarding Automation streamlines the process of onboarding new clients by utilizing technology to reduce manual tasks. It enhances efficiency, minimizes errors, and accelerates decision-making. The user-friendly interface allows for easy integration with existing systems, making it a valuable tool for financial institutions. Overall, it significantly improves the customer experience while ensuring compliance and risk management are maintained. This automation solution is a game-changer for those looking to optimize their credit onboarding processes.

Alternative of Credit Onboarding Automation

36.3M

5.0

HubSpot is an all-in-one customer relationship management (CRM) platform designed to help businesses grow by improving their marketing, sales, and customer service efforts. It offers a suite of tools that streamline processes and enhance collaboration across teams, making it easier for companies to attract, engage, and delight customers. With features like email marketing, social media management, and analytics, HubSpot empowers organizations to create personalized and effective marketing campaigns.In addition to its marketing capabilities, HubSpot provides solutions for sales automation and customer support, enabling teams to work more efficiently and effectively. The platform's user-friendly interface and extensive resources, including educational content and support, make it accessible for businesses of all sizes. By integrating various functions into one platform, HubSpot helps companies build stronger relationships with their customers and drive sustainable growth.

AI Lead Generation

8.5M

4.6

Abdul Malik Ibrahim Jaber Hassan is a prominent figure known for his contributions in the field of technology and communication. With a strong background in digital solutions, he has played a pivotal role in promoting innovative platforms that enhance user engagement and streamline communication processes. His expertise lies in understanding the dynamics of online interactions and leveraging technology to foster better connections between businesses and their customers.As a visionary leader, Abdul Malik has consistently focused on creating user-friendly tools that empower organizations to improve their customer service and support. His commitment to enhancing the digital experience reflects his belief in the transformative power of technology in today's fast-paced world. Through his initiatives, he aims to bridge the gap between users and businesses, ensuring that both parties enjoy seamless and effective communication.

AI Lead Generation

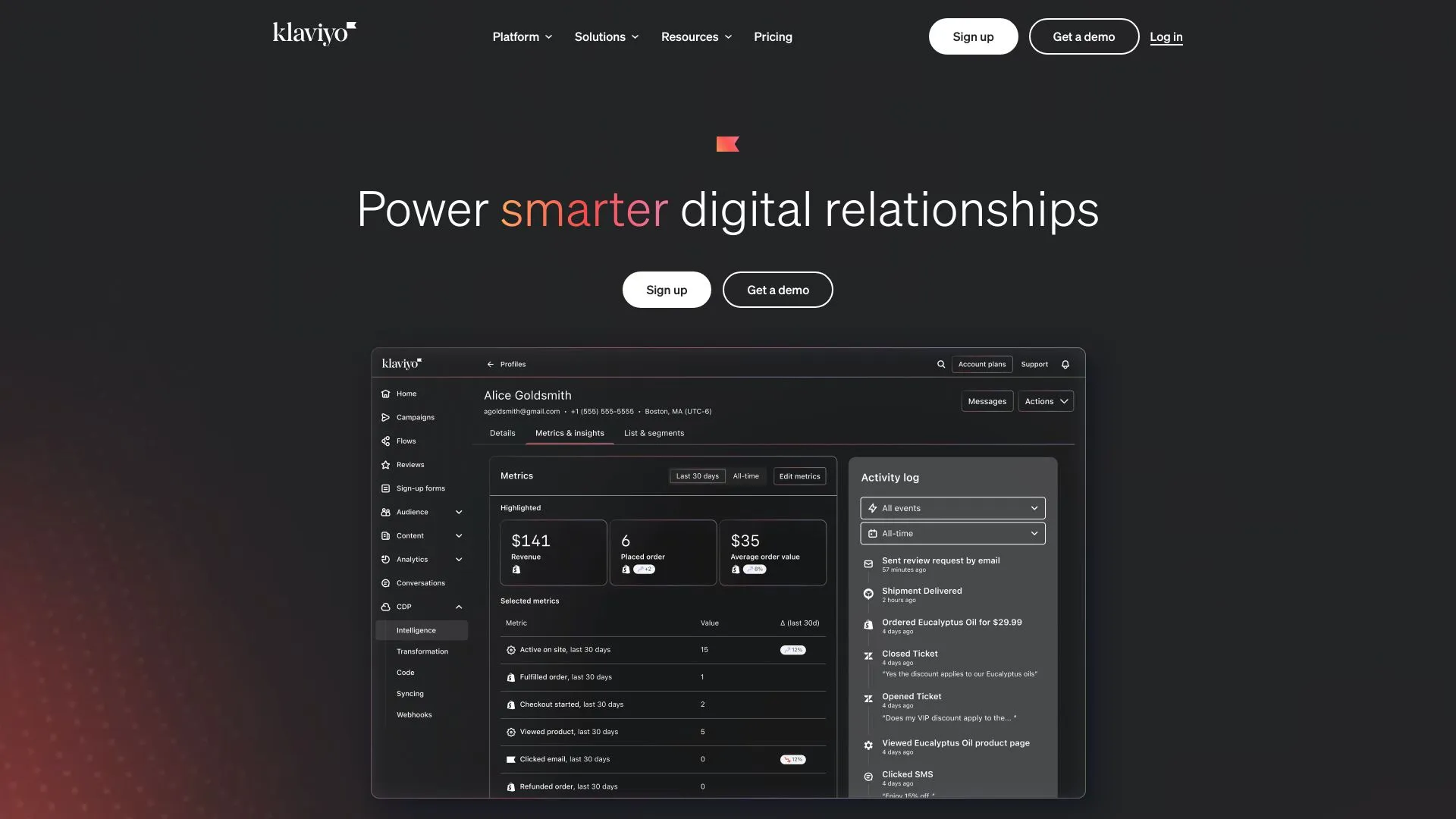

6.0M

5.0

Klaviyo is a powerful marketing automation platform designed to help businesses maximize their customer engagement and drive revenue through personalized communication. By leveraging advanced data analytics and segmentation, Klaviyo enables brands to deliver targeted email and SMS campaigns tailored to individual customer behaviors and preferences. This capability empowers businesses to create meaningful connections with their audiences, enhancing customer loyalty and retention.The platform's user-friendly interface and robust integrations make it accessible for marketers of all skill levels, allowing them to easily design, implement, and analyze their marketing strategies. With a focus on data-driven decision-making, Klaviyo provides actionable insights that help businesses optimize their campaigns for better performance and growth. Whether for e-commerce or other sectors, Klaviyo equips companies with the tools needed to succeed in a competitive digital landscape.

AI Lead Generation

4.8M

4.6

MailerLite's AI Drag & Drop Editor revolutionizes email design by combining user-friendly features with powerful artificial intelligence. This intuitive tool allows users to create stunning email campaigns effortlessly, regardless of their design skills. With a simple drag-and-drop interface, you can easily arrange elements, add images, and customize layouts to suit your brand's aesthetic.The AI capabilities enhance the design process by offering smart suggestions and automating repetitive tasks, saving time and ensuring high-quality results. Whether you are a small business owner or a marketing professional, MailerLite's editor empowers you to produce visually appealing emails that engage your audience effectively. Experience seamless design and elevate your email marketing strategy with this innovative tool.

AI Lead Generation

3.8M

4.9

GetResponse is a comprehensive online marketing platform designed to help businesses grow and engage with their audience. It offers a wide range of tools for email marketing, automation, landing page creation, and webinar hosting, making it a versatile solution for marketers of all skill levels. With a user-friendly interface and robust features, GetResponse enables users to create effective marketing campaigns that drive results.The platform caters to various industries and business sizes, providing customizable templates and advanced analytics to optimize performance. GetResponse also emphasizes customer support and training resources, ensuring that users can fully leverage its capabilities. By combining essential marketing tools into one platform, GetResponse empowers businesses to enhance their online presence and achieve their growth objectives.

AI Lead Generation

2.2M

4.6

Fillout.com is an innovative platform designed to streamline the process of creating and managing online forms and surveys. It offers users an intuitive interface that allows individuals and organizations to build customized forms without the need for extensive technical knowledge. With a focus on user experience, Fillout.com provides a variety of templates and design options, making it accessible for everyone from small businesses to large enterprises.In addition to form creation, Fillout.com includes features such as data collection, analytics, and collaboration tools. This enables users to not only gather information efficiently but also analyze responses in real-time to make informed decisions. The platform emphasizes security and compliance, ensuring that users' data is protected while maintaining ease of access and usability across different devices. Overall, Fillout.com serves as a comprehensive solution for anyone looking to enhance their data collection processes.

AI Lead Generation